Exclusive interview for SPINOFF.COM with Doug Bend the Founder of Bend Law Group, the San Francisco Law Firm that helps startups, entrepreneurs and small businesses succeed

Dear Mr. Bend, thank you very much for dedicating your time to this interview. It is a big honour for us to get acquainted with you and your professional team of Bend Law Group business attorneys and startup lawyers. We are pleased to hear about the legal services you provide to entrepreneurs and startup founders on general counselling, funding and investment due diligence, regulatory permits, licensing and more, in order to share with our professional global community of spinoff founders, investors and partners in the US and worldwide so they may take advantage of your services as well.

Mr. Bend: Thank you for having me. I really appreciate it.

SOC: We would like to start with the overview of the Bend Law Group PC. Please elaborate on the story of its creation. Could you specify what does Bend Law Group specialize on and what services does it provide?

Mr. Bend: I started Bend Law Group in 2010. We specialize in helping out entrepreneurs from helping to launch more than 50 companies a year, to raising capital, to serving as their general outside counsel, to helping them to buy and to sell the companies.

SOC: Brilliant. Could you share your vast experience and your professional background?

Mr. Bend: I graduated from law school in 2006 from Georgetown. The first two years out of law school I clerked for two different judges. I then practised law for a large corporate law firm in New York City before moving out to San Francisco in 2010 and opening up my own firm.

SOC: It is no doubt that one of the most important key element in a successful company is a team. Would you mind to share with our partners who are the members of your team and their professional background and endeavours?

Mr. Bend: There are four full-time employees at Bend Law Group including myself. Of those employees, one is an Operations Manager who helps our clients with governmental filings. The other three employees on our team are full-time attorneys. The way that we've organized a law firm is that each of us does half of the same job such as drafting and negotiating contracts, dissolving companies and other outside general counsel projects. Each attorney also has two or three specialities. For example, Luthien Niland negotiates all of our client’s commercial leases and has enough deal flow to get really good at finding good compromises for tough situations. Vivek Vaidya files over 100 trademark applications per year and helps our clients with brand protection including sending cease and desist letters and responding to cease and desist letter. As for myself, I do a lot of raising capital for clients and, buying and selling businesses. I also have a real estate brokers license and help clients with commercial and residential real transactions.

SOC: Thank you. Your team is very professional and hardworking Mr. Bend. Considering your tremendous experience, we would like to know more about your clients. Who are they? Could you please share the story of the most memorable deals that were closed with Bend Law Group professional legal assistance or other success stories at your discretion?

Mr. Bend: I'd be happy to do so. The client that first comes to mind was actually my first client Modify Watches. Modify makes all kinds of customized watches from corporate watches for Google and Facebook to one of a kind watches for Father’s Day. We helped launch Modify in 2010, raise several rounds of capital and we've many contract negotiations on their behalf. Sometimes our client is just one person working out of the basement of their home who is just getting started his business journey. But over time they may grow into mature companies and we grow with them. We also have clients around the world with hundreds of employees. It is all about fit and the most important criteria is whether we have the legal experience to help them accomplish their goals. whether the client is one person or has hundreds of employees.

SOC: Great thank you so much. It seems that we have lots of clients for you because we have a really big amount of spinoff and startup founders which are growing and would like to have such strong legal support. Go forwards our interview, it is not a secret that it is always better to work with seasoned professionals. Could you explain why is it so important for spinoff and startup founders to work with professional lawyers and legal counsels from the very beginning?

Mr. Bend: I think it's important because if you do a lot of something in life and you have a passion for it you have a tendency to get good at it. The real struggle for early-stage founders is that they have a lot of expenses for the company. They may have very little revenue when they're first starting out and may be using their personal savings. In such case, it is better to work with the attorneys who are used to working with those types of founders that can be strategic with their time and that can add a lot of value to the founders of early-stage business from day one and make sure they are investing in solid legal advice. The analogy that comes to mind is that nobody would like to have a wisdom tooth pulled by a dentist who has never done that procedure before. It is the same for your legal services. You should go to somebody who's done it hundreds or even of thousands of times before because there comes a certain amount of expertise with doing something, again and again, to be able to add the most value back to the client.

SOC: 100 percent agree, Mr. Bend. We know that Bend Law Group provides strong legal support to the US spinoff and startup founders. Our global professional audience that mostly consists of such clients would like to know how can Bend Law Group help them in this regard? And do you provide the legal counselling in fundraising outside the United States?

Mr. Bend: We have clients around the world from Asia to Europe to South America to Africa. Whether we are the best fit for advising a client on a fundraising project depends on where the investors are located at and where the company is located. For example, we can help the founders who are in another part of the world to raise capital, but their investors are here in the U.S.

If it is a foreign business with foreign investors we can connect them with local attorneys. If a UK company is looking to raise capital in the UK, we feel that they may be the best served by a local council in the UK that is used to working with the UK securities law compliance. In this case, we leverage our network to help them find that local council. It's really important to be very honest with clients. If my brother or close friend asked me to work on a project will my reaction be ‘Yes, we do this all-time, we are great at it and can't wait to get started!’ Or is the reaction ‘Well, we’ve never done that before.’ Back to the wisdom tooth analogy, the best thing to do is to find a specialist for them, so the client is best served. In the short run that means we sometimes make less money, but in the long run, we feel it is really key and important to building long-lasting relationships that are built on trust.

SOC: Totally agree. As a rule, there are two main types of financing into spinoffs and startups such as equity financing and debt financing. Please tell us what is the main difference between these two types of financing? What are their peculiarities, pros and cons?

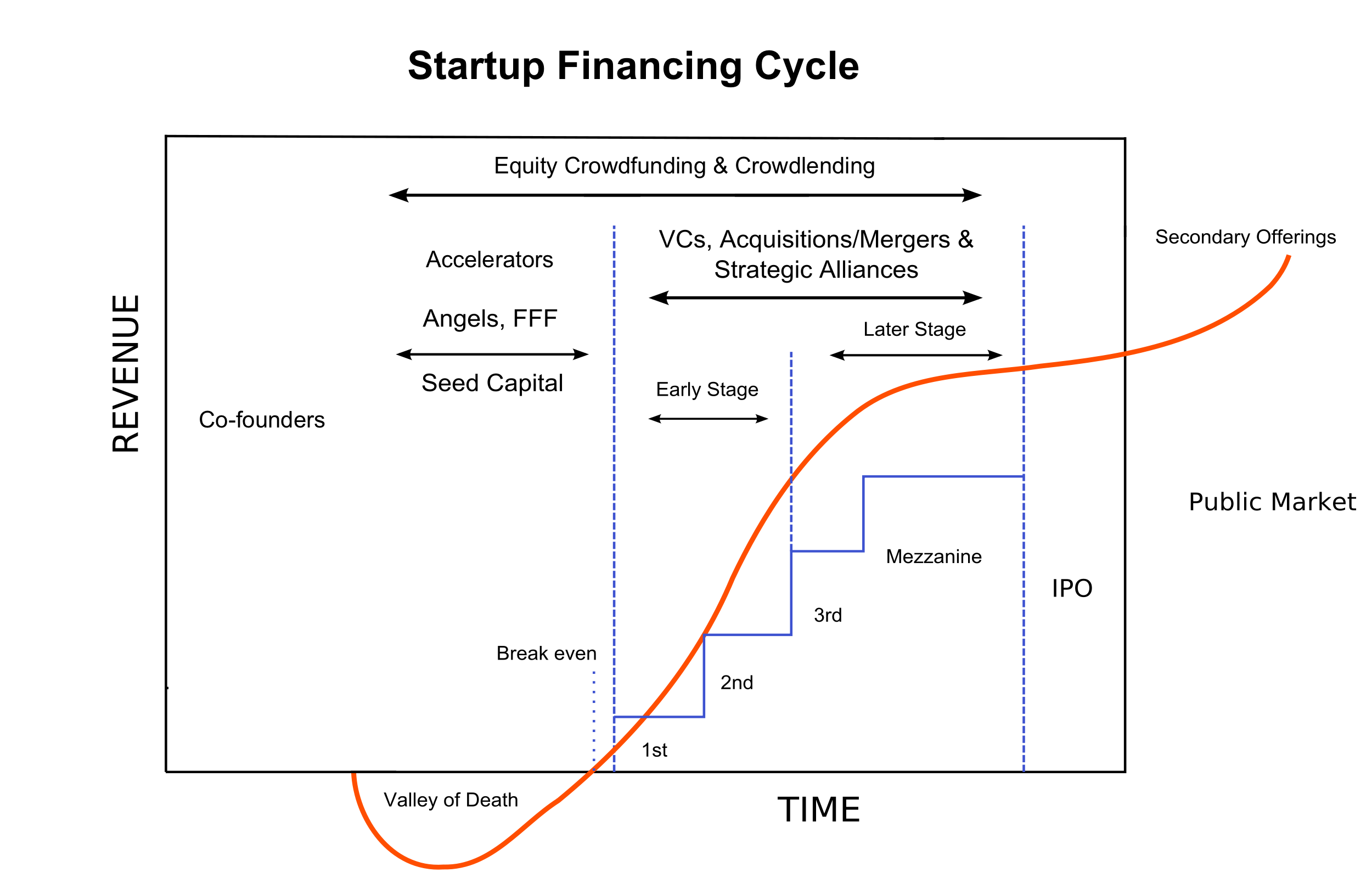

Mr. Bend: A lot of it has to do with the amount of capital that the founder is raising. Typically, for the first round of capital, raising up to a million dollars or, perhaps, even two million dollars that are called a seed round, they will most often use convertible promissory notes or the SAFE documents that the Y Combinator put out. Those are debt instruments that convert into equity down the road. Often when they've raised that first round of capital and going to the second round of capital, a Series A round of capital, that tends to be an equity round of capital. Some companies jump straight to the Series A round, but more often you first have the seed round and then the equity around. The equity round is used for raising more money for the company.

The second major distinction is the amount of time and costs involved with each type of capital round. For the seed round of capital it depends on the number of investors and where those investors are located at, but typically it is much less expensive than a Series A round. For the Series A round, there are a lot more documents involved, it is more intensive and requires a much more thorough due diligence than the seed round. The legal bills in such case tend to be much higher for raising a Series A round. As a percentage of the deal, the legal fees might be roughly the same as you often are raising more money in a Series A round, but there are more legal expenses to do the fixed price equity round of capital.

SOC: Can we say that equity financing is usually more difficult and much more expensive than debt financing?

Mr. Bend: That's correct.

SOC: Based on your vast experience and considering hundreds of successfully concluded deals of your clients that took advantage of your services, could you explain why debt raising would be the best option for our partners while investing in their spinoffs and startups?

Mr. Bend: For the first round of capital debt funding is the best option for two reasons. First, the legal bills are much less expensive for a debt round. Depending on the number of investors that you have, it might be fifteen hundred dollars to three thousand dollars whereas with a fixed price round it can be 10 to 20 thousand dollars. You're looking at roughly 8 to 10 times more in legal expenses for doing the price fixed round compared to the debt round. If you're raising a lower amount of capital a debt round is more efficient. It's also often more efficient in terms of the founder’s time and the amount of time it takes to close the seed round. A Series A round tends to take a lot more time in terms of preparing the documents, negotiating with investors and it takes a lot more of the founder’s time as well. When you're raising roughly a million dollars or less, a seed round can be efficient and take a smaller amount of legal money and the founder’s time to have good customized terms and get that money into the company to see if it is a viable idea. Again, when it comes to raising a bigger round of capital it is more appropriate to spend more time and money.

SOC: Very fair. Now we would like to talk more specifically about debt funding. What exact services do you provide in debt raising and convertible note, what are the main steps of debt funding legal assistance? How long does the whole process of due diligence and documents preparation usually take?

Mr. Bend: There are usually four steps. The first step is helping the founder to prepare a term sheet. That's essentially a page and a half document that highlights the 20,000-foot view of the deal and making sure that our clients understand why we're helping them select certain deal terms and so they can speak intelligently about those terms with investors. That term sheet is part of the pitch deck to investors to try to convince them to invest. Sometimes they say this is what we expect, this is fair, other times there is back and forth with the investors on certain terms and helping the client understand the ramifications of making those changes to the term sheet. Once you have the initial pool of investors gathered the second step is preparing the actual documents for the round. For convertible promissory notes, there are two main types of documents: (i) a convertible promissory note that each investor gets that indicates the amount their investing and the terms of the investment and (ii) a convertible promissory note purchase agreement, which governs the entire round. The third step is once the investors sign the documents, you have a consent of the board directors authorizing that round of capital that's being raised by the company. Lastly, the final step is the securities filings. In most states and many countries when you've raised a round of capital, you have to go through steps for securities filings to make sure it is correctly documented. What's really key about that is that if the correct security filings are not made, the investors down the road can ask for their money back not only from the company but also from the founders as individuals. The founders can be held personally responsible for the investment capital. You really need to make sure that you're doing the proper security filings for each round of capital.

As far as the amount of time it takes. I always hate to sound like a lawyer, but it really varies. Sometimes it can be one or two days when the client already has an investor or a handful of investors lined up, are moving very fast and have a general agreement with the investors of the deal terms for the round of capital. Sometimes it could be months where clients are still going out there and trying to find the investors and it gets stretched out. And so it can really vary the amount of time the round can take.

SOC: Thank you Mr. Bend. Could you specify what are the common mistakes that spinoff and startup founders do during fundraising? Could you kindly share the memorable stories from your career when the spinnoff or stratup founders paid the price for incorrect choice in favour of other than convertible note fundraising?

Mr. Bend: I think there's really two main mistakes. The first is that an advantage of working with an attorney is that good attorneys think two or three moves ahead like in a chess match. They are thinking about not only what needs to be completed for this first round of financing, but also what is going to be required for additional rounds of financing down the road. One of those key items is making sure that everyone that does work for your company signs a confidential information and invention assignment agreement, essentially providing that anything they develop with your company belongs to your company. Not for the seed round, but for the Series A round, the founders will get a due diligence checklist from the investors. It varies from a page long to page and a half long and will include the documents and supporting materials the investors are going to expect the founder to be able to put into a due diligence room for them to review. If you don't have confidential information and invention assignment agreements you're going to have to find those people that did work for your company to sign those agreements and two or three years down the road it can be very difficult to find those people. When you find them you're in a position where you don't have much leverage. They may ask, ‘Why should I sign this document? Something good must be happening with the company. What's in it for me?’ We really encourage our clients who have people that do work for their companies to sign those agreements before they start, instead of trying to chase them down years and years later.

The second major thing is making sure that all the proper security filings are done. For the seed round documents, there are some really good templates out there, but I think really what you need an attorney to do more than anything else is to file the proper securities filings for the company. If they're not done properly, at least in the United States, the investors can ask for their money back. For most things, the founders aren't personally liable, but in the U.S. they can be personally liable if the company is not doing the proper securities filings. If the company doesn't work out, then the investors may get very upset and go after the founder as an individual to get their investment back.

SOC: Thank you Mr. Bend for such a brilliant piece of advice. Anyway, we already see that you are the most devoted to your clients. Let's us help them to understand how they can avoid those fatal mistakes and which piece of advice and warnings you might give spinoffs and startup founders in the sphere of your activity?

Mr. Bend: It is important to choose the right attorney as not every attorney is the same. It's not like buying something where it is on sale one location and is less expensive at a different store. For example, selecting an attorney is not like buying a box of at Cheerios at one store because it's $2.99 compared to $4.99 at a different location. Attorneys have different expertise, different things that they work on, different things that they focus on. It's best to find an attorney who has the expertise and is working on similar matters so to make sure that everything is done correctly. You don't want to be hiring a family law attorney or friend that is an estate planning attorney to do raise capital for the first time. That can be short-sighted. You really want to work with an attorney who deals with this as the key area of their practice and works on it all the time.

Secondly, ideally, your attorney has worked with other early-stage founders and have developed mechanisms and processes that they are able to add a lot of value to your business early on, knowing that there is a chance that a relationship can grow and mature and be something much bigger. They're willing to make an investment early on in you and in your company in the hopes that it develops into a much larger relationship down the road.

SOC: Thank you Mr. Bend. Money is a critical issue for the rising companies. The spinoff founders with who we make the investor-oriented interviews and who are currently at the stage of fundraising would like to know how much do your services cost?

Mr. Bend: There are really two factors. The first factor depends on the type of round of capital. Second, how many investors are going to be involved in the round and where are the investors located? If you have a smaller number of investors, for example, let's say five investors and they're all located in California that's a much simpler project. It may only be about four hours of our time because we only have to do one securities filing and we're only generating documents for four investors. Whereas if we have 20 investors and they're spread out across the U.S. and perhaps across the world, that project could be 10 to 15-hours because there are many more documents that have to be generated and there are more security filings that we have to complete.

The first question we ask clients is how many investors and where are they located at. And from there it depends on the client’s budget. I'm the most experienced attorney at the firm and most expensive. I'm at $495 an hour. We also have Luthien Niland who has been practising for six years and is at $325 an hour and does these kinds of rounds of financing multiple times per year as well. If it is within a budget of a company to work with me that is great and Luthien has done this many times and maybe it makes more sense for them to work with her on the project. We try to find the attorney in our practice that's going to fit the company the most not only in terms of expertise but also in terms of the budget for the project.

SOC: Thank you Mr. Bend. In our case more investors better ha? (both laughing) And the last question. Could you specify how the potential partners can contact you? Should it be mail letter web page inquiry form or a phone call?

Mr. Bend: The best way for them to contact me is to send me an email directly to my account. My email address is doug@bendlawoffice.com. I will connect with them when they reach out and see if the law firm might be a really good fit for working with them and if not make sure that they get lined up with counsel that best fits their company.

Dear Mr Bend, SPINOFF.COM team would like to express gratitude for the interview and all provided information that will allow introducing Bend Law Group to our partners and spinoffers worldwide. SPINOFF.COM will be honoured to maintain and cement relations for the benefit of spinoff founders, partners and all professional audience of the World's Biggest All Science Spinoff Platform!