Exclusive interview for SPINOFF.COM with Brian Dapelo the partner in Monarch Point Consulting Group, Strategy and Operations Management Firm that helps startups, entrepreneurs and small businesses development.

SOC: We're going to start with the first question. Could you elaborate on the story of Monarch Point Consulting Group Creation?

Brian Dapelo: Yes. First off, thank you for the opportunity to introduce our company. We were founded with a simple goal in mind and that was to help businesses become more efficient competitive and profitable. Our firm's leadership comprises decades of experience in business consulting and entrepreneurship. Unlike most consulting firms, we emphasize entrepreneurship because much of our approach and consulting engagements are run like an entrepreneur. We want to get in and be light, lean, and fast. There's a lot of great consulting firms out there that are more than happy to spend years developing a strategy while spending lots of your hard-earned cash, but our track record proves that we can produce similar results with a less amount of time. We don't like wasting our own resources so we don't want to waste our customers either. Our team is comprised of consultants, entrepreneurs, and business owners, all with decades of experience. We just came together and said let's try and help businesses, try and do something a little different than what traditional strategy and management consulting firms are doing. So that was how we were formed.

SOC: Okay that's wonderful. And how about your team? How many people do you have and how many partners? Do you share different regions or specific work? How does it work?

Brian Dapelo: Right now, we are a partnership - myself and Mark Bobseine are the partners of the company, and we work with other contractors, freelancers, and our consultants, depending on the client engagement. For example, we may meet with the client to ascertain strategy, and if that strategy is within our core competency, we alone will go ahead and execute with our associates but we also work alongside a lot of other consulting companies. Also, we will not just send the partners in to negotiate a deal and then send a bunch of associates to do the work. We work alongside our associates. It's not like we're just sending a kid fresh out of college who’s still wet behind the ears to work on the engagement. We actually do the client work alongside our team. So right now, our network consists of probably about five or six other firms that we work with alongside to offer all our services.

SOC: That sounds wonderful. Brian thank you so much. And let's move forward to our clients - Spinoff founders. In that sense could you describe in general what kind of services your company provides for the entrepreneurs.

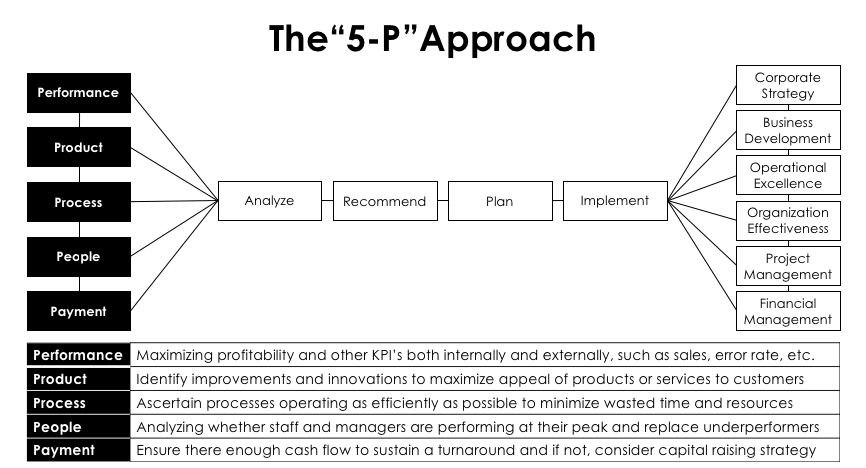

Brian Dapelo: Absolutely. So long story short, we're boutique strategy and operations firm. Within strategy and operations, we mainly assist businesses with specific services including corporate strategy, business development, operational excellence, organizational effectiveness, project and program management as well as financial management. We use a bunch of different tools and methodology and approaches within those services to deliver value. Really, that depends on the client's unique circumstances. No client engagement is alike and we apply bespoke solutions, methodologies, and tools to each engagement to make sure that we're not offering “canned” solutions. Spinoffs are going to have unique situations and that is going to determine the services that we would offer. I would venture to assume that most of the spinoffs are going to be specialists in their respective fields and not necessarily business specialists. So, to that end, we are the business experts and we can help with all stages of founding a business, from the initial stages of writing a business plan to developing a fund-raising strategy, and everything in between. In some cases, a spinoff may have an MVP, maybe have positive cash flow, or maybe they're past breakeven. We can still help dramatically by increasing revenue and cutting costs, as we do with much of our more established clientele. You know, that the traditional management consulting model isn’t just available to a major Fortune 500 companies, with billion-dollar balance sheets anymore. There's a lot of startups that are starting to acknowledge the value that management consultants can provide. We've actually dealt with a lot of startup businesses as well, so we've got a wide range of experience working with startup clients up to major Wall Street firms and multinational corporations. So again, we can tailor our unique approach to the client’s needs depending on what they're looking to do.

SOC: That sounds impressive. And staying on the same question, naturally, when it comes to building a strategy for a business, someone who is not into the business like our clients who are mostly scientists, would probably make some mistakes. What kind of mistakes can be avoided using the services of Monarch Point Consulting Group?

Brian Dapelo: That's kind of the value of management consulting. We are entrepreneurs first, as I emphasized early on in the first question. We've “been there done that,” and we’ve made the wrong decisions. I personally would rather hear the advice or counsel of someone who's been there and made mistakes, than some person who just got lucky one time. There are a lot of other successful entrepreneurs out there that haven't really been through the school of hard knocks as entrepreneurs. I've been there personally. So, I think that's kind of where our value comes from because, we've been in this situation before, here's what we learned, and we want you to learn from our failures. Don't make the same mistakes we have or others in our network have. And that's really where I think we can provide the most value to the spinoff companies.

SOC: You know how they say you get experience from your mistakes but build a career on the mistakes of others.

Brian Dapelo: Absolutely. Absolutely correct.

SOC: The most painful question for each in business whether it's startup or spinoff is raising funds and moving forward, what type of a fundraising can your advice for a spinoff and why?

Brian Dapelo: Like I mentioned above, every client's circumstances are different. Ideally, a spinoff would find a wealthy individual, that's very well off, and just says, “Hey I've got all this money sitting on the sidelines, here you go, I don't care what you do with it. Good luck and hope you make some money out of it.” That's highly unlikely and we’re helping our clients to find the next best option. For the average person like the rest of us, you have this great idea, you want to take it to market but you need capital to do so. You don't want to automatically assume that going to a venture capital firm, who will ask to take over a majority interest your company, is going to be the best option. In some cases, we typically advise against the use of debt, but in some cases, if it's a short-term financing solution and the client has backorders to cover the interest, we may recommend a debt option. In some cases, maybe the venture capital option for a minority or maybe even a controlling stake may be an option. But looking at each client's unique circumstances allows us to assess the situation and provide the best strategy and how to get funding and explore the other options in more detail. Our approach really isn't saying, “Here's what we think, go do it.” Rather, we say, “Here are some options, here are some of the pros and cons,” then we work with the client to decide the best course of action. We then provide coaching to the client. Everyone should know in business that “No plan survives the first contact,” as General George Patton once said. We understand that circumstances may change and that may need to lead to us reassess the plan. So that's something we offer to our clients as well.

SOC: Okay. Yes sounds fair. Of course, each case is individual and naturally, each client has specifications. Thank you. Of course, your services are not for free so the question our clients will arise will be the price. Naturally, each case varies, but what is the range they need to take into account and whether there is any discount for the clients from us?

Brian Dapelo: Sure. I'll start by saying you get what you pay for. We don't offer cheaper discount advice because the advice we offer would be just that, cheap. On the contrary, we are not MBB or a Big Four consulting firm, so we're not going to be charging outrageous sums and extending our engagements. We do, however, understand that cash is incredibly tight with spinoffs because essentially, they're undertaking an entrepreneurial endeavor. As I’ve said, we've been there as well, and we understand that cash is tight and we pride ourselves on our resourcefulness. We're operational strategy consultants. We know how to do a lot with a little. So, if a client comes to us with a certain budget and timeframe, we'll assess the situation and let them know whether we can deliver results under those confines. If there just isn't a way we can do so, we won't take on the project. It's not that we can't solve those problems, but in some cases, the problem can be solved but the price going to be above what the client is able to afford. So, in that case, we'd rather not take a project because we’d be giving them a cheapened product just to meet their budget. We want to make sure that we're still delivering value under their budget, and in some cases, we can't do that. So, we'll be forthright and say that. We don't like surprises and don't want to be in that kind of situation when a client’s got a prearranged budget and as we start working we realize that it's going dramatically above that limit. Instead, if a client says my absolute budget is $X, we are beholden to not going over budget and if we go over a slight amount what that cost to make sure that we promised to deliver, we'll make sure and deliver it. But if for example, we're looking at a material difference to the tune of $10, $20, $30 thousand dollars over budget, that's something to reassess and make sure that Okay can we do this to make sure that we're serving the client. So, to answer your question, we work with client budgets. For example, we literally had one client say they have three hours and a couple hundred bucks to figure out this problem, can you help? It was a personal friend and I said, “You know this is kind of unusual, but I'll see what I can do.” He was trying to raise some funding and get some strategic advice, and sure enough, within a couple hours we were able to get a solution and he actually got his funding. So that there's really nothing too small that we can't handle.

SOC: That's impressive. I understand you mostly work with startups and entrepreneurs. Could you give a couple of examples, if it's not disclosure of your clients?

Brian Dapelo: Sure. I can't divulge client details though. We operate heavily on the protocol that we never disclose client’s information, even if they allow us to disclose. We kind of prefer the confidentiality, so I won't disclose clients' names. But we have worked with a variety of different startups and tech startups, food product startups. If you visit, our website, we have several different examples of cases that we worked out in detail. I guess one of the most notable projects was a tech startup that we were working with. They came to us and they were asking to revise their operational model. We had assumed that they had something in place when we got on the ground, we realized that they had, in fact, asked us to build it from scratch. These things happen. Sometimes the client thinks that it's a certain way and we get in and realize this is a lot more complex than originally thought. Nevertheless, within a two-month period, we were able to build an operational model completely from scratch with a zero percent error rate, and we design that model for scalability. So again, this is one of those tight budget tight confines timeframes that we had to operate under and we were able to deliver the operating model while documenting all policies and procedures so that they could replicate that success when they scale into new markets. Being forward thinking under a tight budget and a tight time constraint helped to allow the client the opportunity to replicate that success when they ended upscaling. They didn't really think to do, that but it ended up paying off in the long run so they did not have to reconstruct and reassess a whole new market entry project when that time came.

SOC: So it's quite difficult I can imagine but still impressive. We’ve also looked through the website and got some positive feedbacks from different sources about Monarch Point Consulting Group. It is very impressive.

We would like to express gratitude for the time you have dedicated to this interview. SPINOFF.COM is happy to have such professional and experienced partner in our syndicate.