Exclusive interview for SPINOFF.COM with Jonathan Harris, the Editor of Spinouts UK, Young Company Finance

Jonathan Harris is the Editor of Spinouts UK. After graduating from the University of Cambridge, Mr. Harris joined The Ben Line, a Scottish shipping group, and after four years in Japan, he worked with the group’s offshore drilling subsidiary Atlantic Drilling Co Ltd. eventually serving 15 years as director and general manager. In the early 1990s, Jonathan left Ben Line and started working with young companies, in various roles including advisor and interim chief executive. He acquired Young Company Finance (YCF) from its founder Gavin Don, now Visiting Professor at the University of Edinburgh’s Centre for Entrepreneurship Research in November 2000. Since February 2011 YCF’s activities in Scotland have been operated in partnership with LINC Scotland, the business angel capital association, of which Jonathan is a director. LINC Scotland has a membership which includes many active individual investors and most of the main angel groups or syndicates. It represents the members at government level in Edinburgh, London and Brussels. Jonathan has carried out a range of research studies in the young company sector, including the Risk Capital Market in Scotland report for Scottish Enterprise from 2009 onwards.

S.O.C.: Dear Mr. Harris, thank you very much for dedicating your time to this interview. It was a huge honour for us to get acquainted with you in April 2017. Since that time we were glad to support your journalists with some materials and knowledge that we have and we are happy to do this in future. Thank you for your support and your Quarterly Journals that are always brilliant and shed light on the UK spinouts activity. We know that our collaboration in some very common issues is and will be long-lasting and fruitful for both of us and of course for the spinoffs and spinouts in the UK and worldwide. We are happy to have you as our competence centre expert and we would like to share your tremendous experience with our partners and spinoffs.

As we know the Spinouts UK project was launched by Young Company Finance to conduct an ongoing survey of all spinouts from universities across the UK. We would like to start from the overview of Spinouts UK. How did you come up with this project? Could you please elaborate on the story of its creation and the team?

Mr. Harris: I have been publishing a monthly journal, Young Company Finance (YCF), which covers investments in early stage Scottish companies for over 15 years now. I started a new edition of YCF to cover the North of England and found that I needed to get details of spinouts from universities in that area. This was not easy, so once I had the information from a few universities, I decided to go ahead and compile similar data for all universities across the UK. The North of England edition of YCF is no longer published, but the Spinouts UK project has grown to the point where we have over 2,500 companies listed - this includes companies no longer trading, as some researchers want to use the data for analysing the rates of spinout creation and survival rates, while others want to use the database to track current spinouts and start-ups. The project also includes information about spinout origins, its activity, its growth, and its current status, providing a regularly updated continuous time series of data.

During our last visit to London, we had noticed such trend that in the UK it is more popular to say "Spinouts" rather than "Spinoffs". What is your personal opinion on this issue? Don't you mind if I will continue our interview with the word "spinoff"?

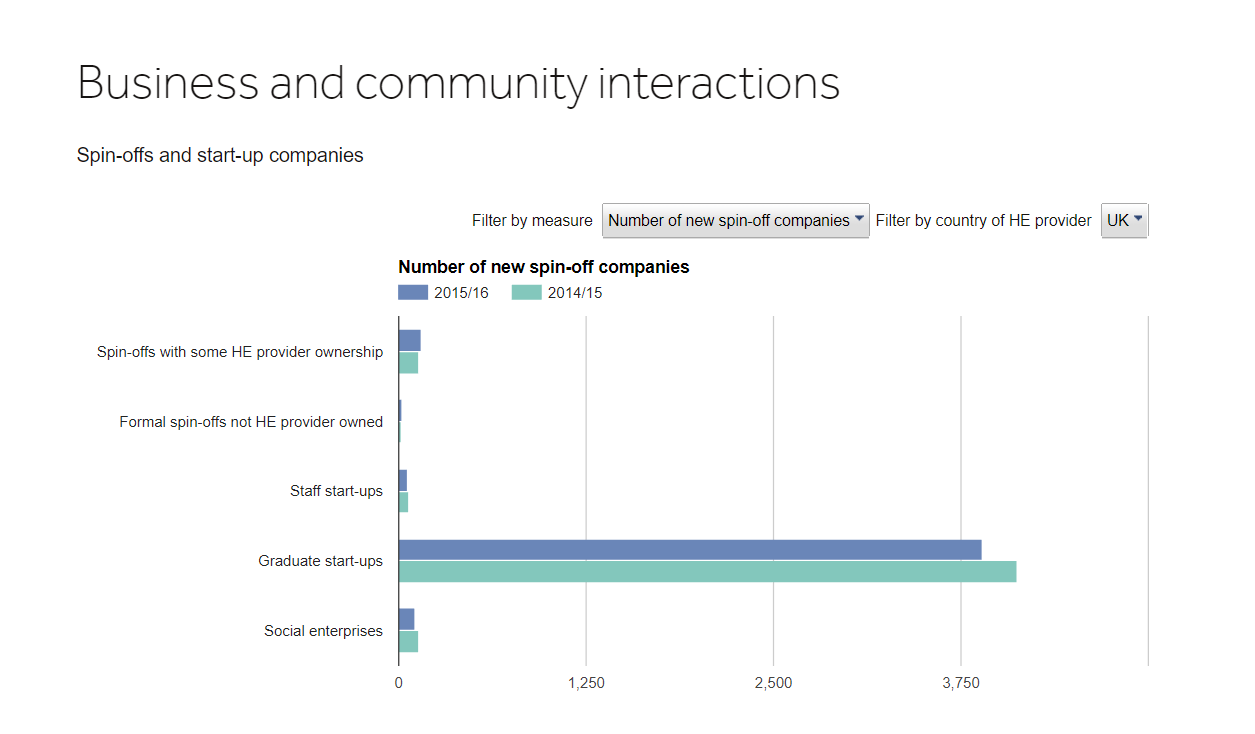

I and many others in the sector prefer the term 'spinout', but your own organisation is not alone in referring to 'spin-offs' - the official Government statistics produced by the Higher Education Statistics Agency (HESA) in the UK also uses this term. I have to say that both terms, spinout and spin-off, are very loosely used, even by some in the university community, but the official definitions are quite strict. But by all means please keep referring to spin-offs.

We know that last month you have participated in the PraxisUnico Conference in Sheffield which unites universities' technology transfer specialists and investors, involved in spinoff activity. Sadly, but this year our team couldn't join this event at Sheffield Hallam University. Could you share with us what's new in the UK spinoff activity and what was interesting for you to know during the conference? In your opinion, should our team participate in this event next year? What are the recent investors' priorities in choosing spinoff companies?

I can say that spinouts are only one part of the commercialisation activities and a very specialised one at that. It takes much effort and expertise to prepare a venture for spinning out, and I think that those universities which are keen to see intellectual property be applied to the everyday world through a commercial company have a much better understanding of what is required than was maybe the case ten or so years ago. I think that Praxis Unico does a splendid job, not only of running courses for technology transfer practitioners but also by bringing the whole tech transfer/knowledge exchange community together, as there is so much to learn from each other. One session which I found particularly interesting at the PraxisUnico Conference was discussing the potential for universities, or groups of universities, to set up their own investment funds. Investment is crucial for spinouts to reach the market, and there are already some excellent examples of university funds which can draw in investment from other funders in the sector. I think you should participate this conference next year because there is much to learn and I think it will be really helpful.

Taking into account the names of our platforms and our activity, for sure, we have lots of in common, and even if to talk about colour palette Spinouts UK and SPINOFF.COM look like brothers. Your web-site is really good ordered and is a resource pool for people involved in technology transfer activity. Visitors can find all names of recent universities spinouts, start-ups (not based on university IP) or others from non-profit organisations and the list of the top universities where they came from. You even made a brilliant analytics on how many spinoffs have the United Kingdom's universities produced.

Thank you. As you know, we publish a Quarterly Journal, which is free and has a wide circulation in the sector. Besides giving a 'digest' of the latest spinouts being formed, details of major investments and of exits (trade sales and IPOs), and news about the sector generally, the QJs serve as a discipline for us to research new information and keep our database up to date. Our Annual Report gives a breakdown of trends in the world of UK spinouts, with analysis of spinouts by sector, location, success rates, and so on.

Could you please describe what does Spinouts UK specialise on? Don't you think of opening the European branch of it, because in Europe as I know there no equal platforms?

For the moment, we are focusing on spinouts from UK universities, but we did some work last year tracking spinouts from universities across Europe. It seems that there has been relatively little attempt to look at spinouts on a consistent basis so that comparisons can be made, and we would like to return to this at some point and develop it further. During this research, we developed good contacts with others interested in collaborating such a project, from a number of different countries. The other development we would like to pursue is 'telling the story' of the successful transfer of university research into sustainable businesses which help society as a whole as well as being commercially successful - this is an area where I'm sure SPINOFF.COM and Spinouts UK can help each other.

That sounds great! To continue the issue of collaboration our spinoffers and I would like to know which problem you might solve for spinoff founders and why Spinouts UK and its Quarterly Journal can be helpful for them?

Many people want to have an easy to follow survey of spinout activity at universities, but the information is not easy to find. Our Quarterly Journal gives current information in a way that helps readers get a good overview of the sector, whereas policy researchers and others looking at the impact of spinouts as a form of commercialisation can use the complete database, which we believe is more comprehensive and reliable than any other source. We are happy to share our Quarterly Journal and the subscription is free. Our latest Quarterly Journal can now be downloaded as a pdf file. Please feel free to share with any colleagues or other contacts you feel might be interested.

Mr. Harris, your Spinouts UK slogan "From Research to Market" speaks for itself. Based on your vast experience of working with young companies, which bits of advice and warnings you might give to spinoff founders? What mistakes, in some cases even fatal, should they avoid?

The main advice I would give to spinouts founders (and their advisers) is to know your market extremely well so that you understand what types of customer will want what you can provide, and how valuable it is to them. One of the best ways of looking at this is to map out your competitive positioning - what competitors do you have, what are they doing that you can't do, what can you offer which they can't match, are they reaching the same customers that you are targeting, are you able to withstand any reaction from them when you enter the market.

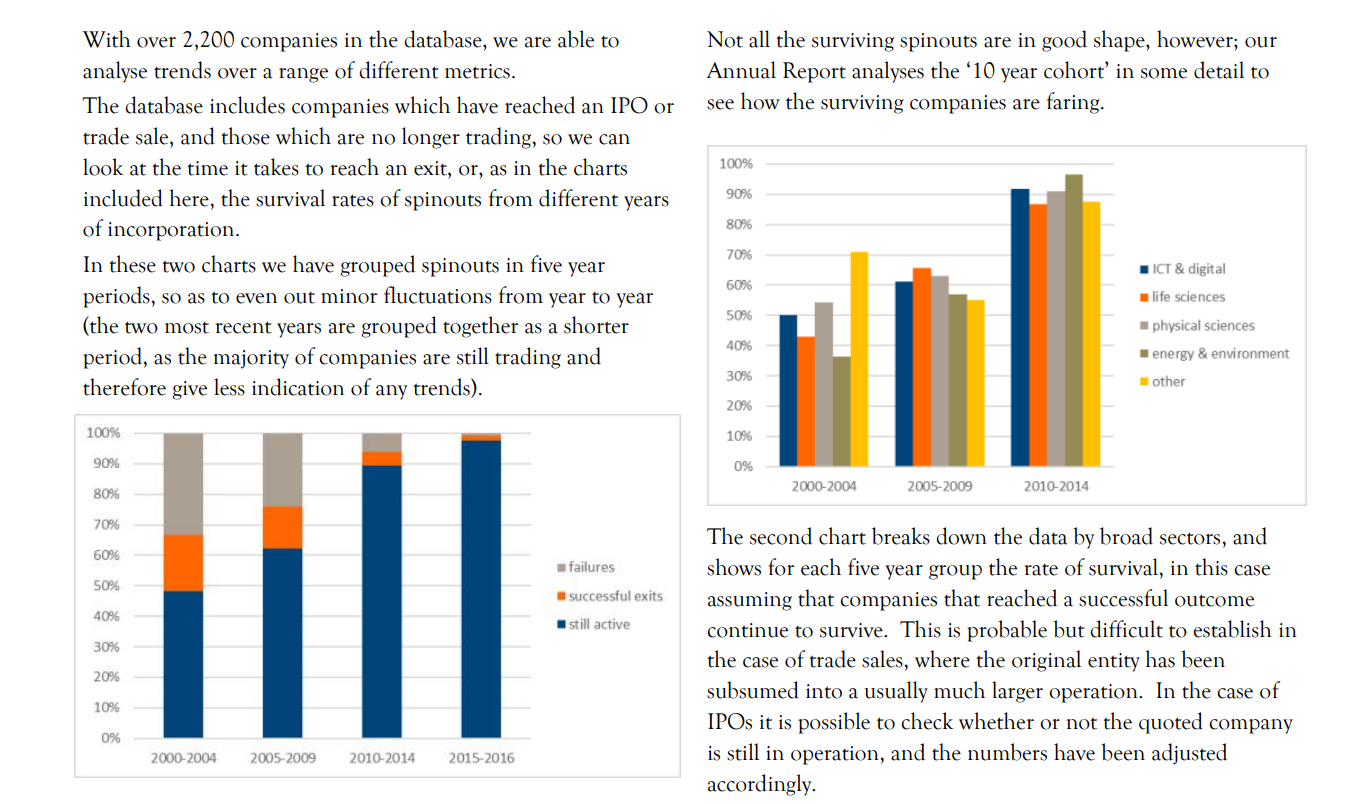

Money is a critical issue for the rising companies. You know better than anyone because you make evaluation and analysis, describe the investors and the amount of funding into the UK spinoff companies. For example, in the recent issue #23 of June 2017 Quarterly Journal, you evaluated the survival rates of spinouts. Could you tell us few words on this? What, in your opinion, UK Spinoff founders need to take into account?

This article highlighted the sort of analysis that we do in the Annual Report. The 2017 Annual Report will be sent to all Spinouts UK partners and subscribers. If people are non-partners or subscribers but would like to see the Report it will cost £25 (inl p&P) and can be ordered from Spinouts UK by e-mail which is on the web-site. To summarise, spinouts survive much longer than lots of people think they do. With a caveat that there may have been some exits which we have not yet tracked, the survival rate of almost 50% of companies formed between 2000 and 2004 contradicts those commentators who believe that most university spinouts fail within a few years of start-up. By far the largest sectors in terms of a number of spinouts are the ICT/digital and life sciences categories.

I know that you have a tremendous catalogue of universities on your website. What are the current top 5 universities which make hundreds of the successful spinoffs annually, of course after Cambridge and Oxford?

This changes from year to year, and you have to take a long view, over a number of years as circumstances change nationally and locally. In our 2016 Annual Report, we found that after Oxford and Cambridge the five most active universities in spinout creation were University College London, Edinburgh, Imperial College London, University of Manchester and the University of Warwick. This list is based on ten year's activity rather than just 2016.

Thank you, it was extremely informative. To continue, we know that in the UK more than in any European country technology transfer activity is almost on the top level or at least well established. Could you advise on some special tips while contacting UK universities TTOs? Do they really need some due-diligence in fundraising for their science spinoffs, do they really want to support the university spinoffs or there are some pitfalls?

The TTOs with whom I am in contact are generally very open to hearing from any organisation that might be able to help with the spinout process if such an organisation can provide evidence of how effective it is. In my view it is almost impossible to understand a business sector 'from the outside', and attracting knowledgeable and experienced managers to early stage companies is a major difficulty, but one that can be instrumental in helping spinout to reach its potential. Anyone who can help in this respect would be welcome in most universities I speak to! I would like to add a further point. It could be helpful for you to introduce investors to TTOs, who usually need to find investment to help to get spinouts to market. This is especially true if the investor has some business knowledge, contacts or sector experience etc.

Dear Mr. Harris thank you for such inspiring words. We will continue our activity and your advice will help us to identify the right approach to present ourselves and to establish good relations with UK universities TTOs as we successfully did with European. SPINOFF.COM founder, our team and I would like to express gratitude for the interview and all provided information. We are happy to introduce you and Spinouts UK to our partners and spinoffers worldwide. SPINOFF.COM will be honoured to continue our relations and to make them stronger each year based on loyalty and mutual respect. You have a really impressive list of partners and we would like also to see our logo among them in future!